The “Returned Value Formula”: Earnings-Weighted Funding at Texas State Technical College

Summary: In 2013, Texas lawmakers and the Texas State Technical College (TSTC) Board of Regents created a funding formula for the state’s technical college system that was entirely based on the earnings of students — an unprecedented model in American higher education. The “Returned Value Formula” determines the state’s allocation to TSTC and the individual campuses within the system by calculating the direct and indirect value that higher earnings from TSTC students adds to the state economy. Since its implementation in academic year 2014, the TSTC earnings-based funding model has shown enormous success in bettering student career outcomes and increasing TSTC’s economic return to the state. TSTC boasts a 35% increase in TSTC’s yearly economic return since 2014, along with a 61% increase in first-year student earnings from 2010–16. Earnings-based funding in Texas technical colleges has helped TSTC students and the state of Texas to prosper.

Development

The goal of performance-based educational funding (PBF) is to ensure that institutional incentives are aligned with long-term student success by improving student preparation for high-earning careers. However, there are two problems with the way that PBF has been implemented in most cases in American history:

- The metrics chosen are easily gamed and do not necessarily align with long term success.

- The percentage of state funding allocated through PBF is too small to have an impact on institutional incentives.

One exception is the state funding model for the Texas State Technical College (TSTC) system. Beginning in 2014–15, the Texas General Appropriations Act began to allocate state formula funding for TSTC campuses through a “Returned Value Formula”.¹ This monumental step forward in performance-based formula funding — allocating the entirety of state formula funding to technical colleges based on student earnings — was entirely unprecedented in American higher education.

TSTC commissioned the model from the state, committing themselves to, as TSTC Associate Vice Chancellor Marlene McMichael said, “directing the right outcomes for our students, our industries and our state, with the risk all on TSTC.”

This novel funding formula is still in place today.

Development Timeline:

- 2009 — GAA (SB1, 81st Legislature) mandated that THECB study the feasibility of developing a “returned value” funding model for TSTC.

- 2011 — GAA (HB1, 82nd Legislature) mandated the recommendation of a new earnings-based TSTC funding model.

- 2013 — GAA (SB1, 83rd Legislature) is for funding in the 2014–15 biennium, laid out below.

Model

For TSTC, funding is determined by the earnings of a cohort of students who attended TSTC 8 years prior to the budgeted biennium.² The cohort includes all students who were enrolled in TSTC and earned at least 9 semester credit hours during the two-year period, but excludes students who received a TSTC degree within two years after the biennium (these are counted in a later cohort), students who re-enrolled in TSTC within two years, and dual credit students.

This earnings metric includes graduates, transfers, and students who leave the college — incentivizing schools to improve student earnings in whatever way is most effective.³ Earnings data comes from the Texas Unemployment Insurance (UI) wage records at the Texas Workforce Commission, which means that students who are employed outside of the state are not included in the data, and that any wages that are not reported are not included.

Funding is provided based on the Fundable Value Added, the sum of:

- the Direct Value Added (the Average Annual Inflation-Adjusted Wage⁴ minus the Texas Annual Base Wage, times the State Effective Tax Rate); and

- the Indirect Value Added (the Direct Value Added times an economic multiplier of 1.5).

The state and TSTC split the economic value added evenly, so the Fundable Value Added equals the sum of the Direct and Indirect Value Added, multiplied by the number of students in the cohort, divided by 2. In the case that the state doesn’t decide to fund the full amount of the TSTC system’s Fundable Value Added, each college gets an assigned Percent of System Funding equal to its portion of the system-wide Fundable Value Added.

Smart Funding for Any Fiscal Situation

The Returned Value Formula allows the TSTC system to allocate funding effectively no matter the general fiscal situation in the state.

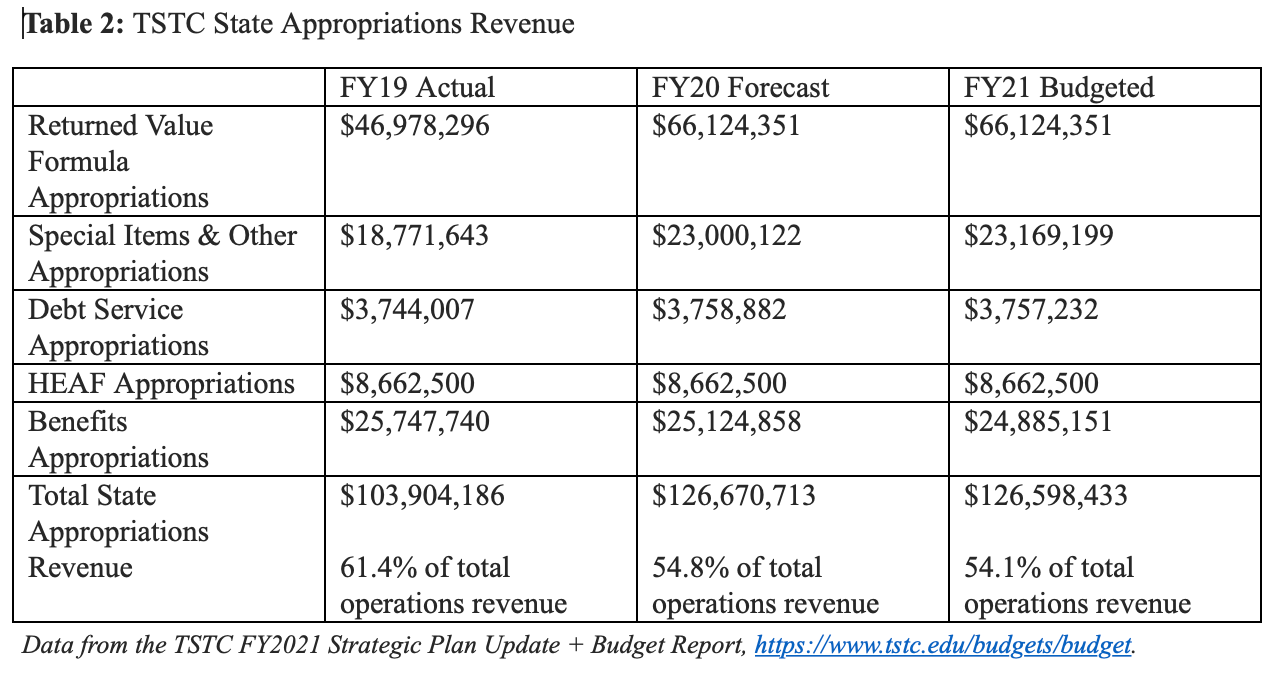

Due to a tight budgeting cycle in 2018–19, Texas didn’t fund the TSTC system’s entire Fundable Value Added, with a difference of about $25 million between the Returned Value Formula’s Fundable Value Added and the state’s actual appropriation. The individual TSTC colleges were allocated funds using their Percent of System Funding from the formula, though it was significantly below the Fundable Value Added calculation based on student earnings. The state was able to maintain the incentive for schools to improve long-term student earnings by still allocating available resources according to institutional performance.

In 2020–21, the state did fund according to the Returned Value Formula, meaning that TSTC received a hefty 41% ($19 million) boost to their annual formula-funded appropriations from the previous biennium.⁵

Results

The Returned Value Formula methodology has shown amazing performance results for TSTC students in the workforce. The first-year earnings of TSTC students increased by 61% from 2010 to 2016 and there has been 66% growth in TSTC degrees and certificates from 2009–18. There has also been a 35% growth in TSTC’s economic return to the Texas workforce since the Returned Value Formula was first implemented in 2014–15, with over $370 million generated by TSTC students according to the Returned Value Formula for the 2020–21 biennium.

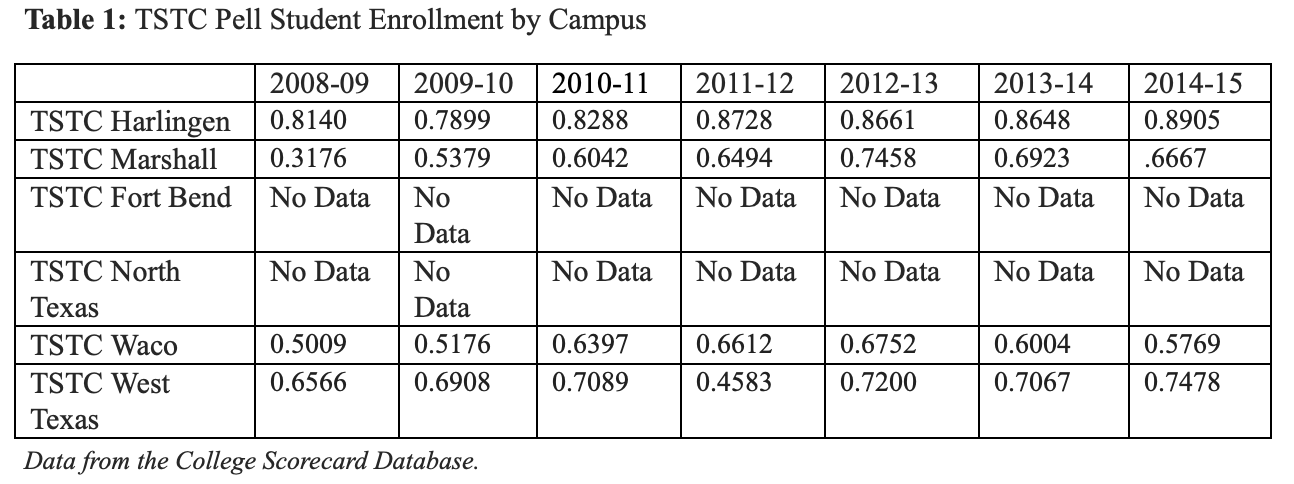

These results are especially impressive as the system has maintained a high number of Pell-eligible students as a percentage of total enrollment. According to available data from the College Scorecard, schools in the TSTC system typically enroll Pell-eligible students as more than 50% of the total first-time, full-time student population and Pell-eligible students even topped 80% of the population in one technical college.⁶ Given that low-income students tend to have lower earnings outcomes than their peers, the ability of the TSTC system to increase earnings and graduation rates while maintaining a steady, or even increasing, percentage of Pell-eligible students points toward earnings-based funding as a way to improve postsecondary results for the students who need it most.

¹ Developed in preceding years (SB 1, 83rd Texas Legislature, Section 11, Page III- 210).

² There needs to be five years of earnings data available to determine the budget, so the cohort biennium is 8 years prior to the budgeted biennium (for the 2020–21 GAA, for example, the Act is written in 2019, so the latest available data is 2018, meaning that the 2012–13 student cohort data is used).

³ Additionally, if a student is unemployed for one or more quarters in a year, this student’s earnings are excluded for that year.

⁴ TSTC calculates the Total Incremental Average Annual Inflation-Adjusted Wage for the system and for each college, which is equal to the Average Annual Inflation-Adjusted Wage minus the Annual Base Wage, multiplied by 5. TSTC calculates an Annual Base Wage by multiplying the current year’s state minimum wage by 2080 (the number of hours a full-time worker works in a year). TSTC calculates an Average Annual Inflation-Adjusted Wage using 5 years of earnings data after the student leaves TSTC, creating a sum of the Annual Inflation-Adjusted Wages for those five years, and dividing by 5.

⁵ See Appendix, Table 2.

⁶ See Appendix, Table 1.

Appendix

Resources

Texas Higher Education Coordination Board. “Texas State Technical College System Returned Value Funding Model Methodology.” https://reportcenter.highered.texas.gov/reports/data/texas-state-technical-college-system-value-add-formula-methodology/.

Texas State Technical College. “High-Value Results for Students, Employers, and Texas.” https://www.tstc.edu/86thsession.

Texas State Technical College. “Texas State Technical College Planning and Budgeting.” https://www.tstc.edu/budgets/budget.

Texas State Technical College. “TSTC Funding Formula.” https://www.tstc.edu/about/funding.

Stay Informed

Sign up to receive updates about our fight for policies at the state level that restore liberty through transparency and accountability in American governance.