Unleashing the Palmetto Economy:

How Bold Procedural Reforms Can Make South Carolina a National Leader in Regulatory Reform

Introduction

South Carolina is the fastest-growing state in the nation. Boasting 1.7 percent population growth in 2023, South Carolina eclipsed even Florida and Texas, attracting families and businesses with its relatively low prices, low taxes, strong labor markets, and a state government viewed as competent and responsive to constituents.1

South Carolina is now home to 491,688 businesses, enjoying the nation’s ninth-fastest business growth rate in 2023.2 This rapid population growth translates to economic dynamism. Major employers have flocked to South Carolina, spurred on by a combination of strategic location, skilled workforce, and robust infrastructure. These trends suggest the Palmetto State is on the cusp of even more significant economic expansion.

Yet South Carolina’s promising trajectory is undermined by a legacy of regulatory constraints that have accumulated over time, slowing innovation, deterring entrepreneurship, and creating unnecessary burdens for citizens and businesses. While South Carolina’s relatively low tax environment and political climate attract businesses, the state’s regulatory framework—adopted piecemeal over many decades—still lags behind best practices. In our latest annual ranking of state-level administrative procedure acts (APAs), South Carolina finished 37th. Our rankings award points for promulgation procedures, including automatic rule expiration, cost-benefit analysis standards requiring that a rule’s benefits exceed its costs, independent gubernatorial oversight of rulemaking, and legal freedom for plaintiffs to contest regulations in court.3 South Carolina failed to earn full points across all metrics, indicating ample room for procedural reform. The outcome of unaccountable regulatory procedures is regulatory inertia that stymies South Carolina’s economic strength. The South Carolina Code of Regulations (SCCR) contains 83,372 instances of restrictive language (such as “shall,” “required,” or “prohibited”) embedded in nearly five million words of legal text as of 2023, reflecting an intricate web of red tape that can perplex business owners and deter investors.4

Root problems run deeper than merely having too many rules. South Carolina’s regulatory code is thickly layered with legacy mandates that never truly expire. Although agencies must review their rules periodically, there is no statutory mechanism to eliminate those that are outdated. As a result, South Carolinians must comply with a sprawling patchwork of directives that may no longer reflect current realities or even current statutory delegations. Worse, judicial review defers excessively to agency interpretations—South Carolina’s courts uphold an even more deferential standard than the much-lambasted and recently overturned federal Chevron doctrine. In practice, this means that courts in South Carolina may be unlikely to rule in favor of a citizen or business owner suing an agency, effectively weakening the critical judicial check on administrative overreach. Expansive deference not only undermines the balance of powers but also discourages agencies and legislators from drafting rules with precision and accountability in mind.

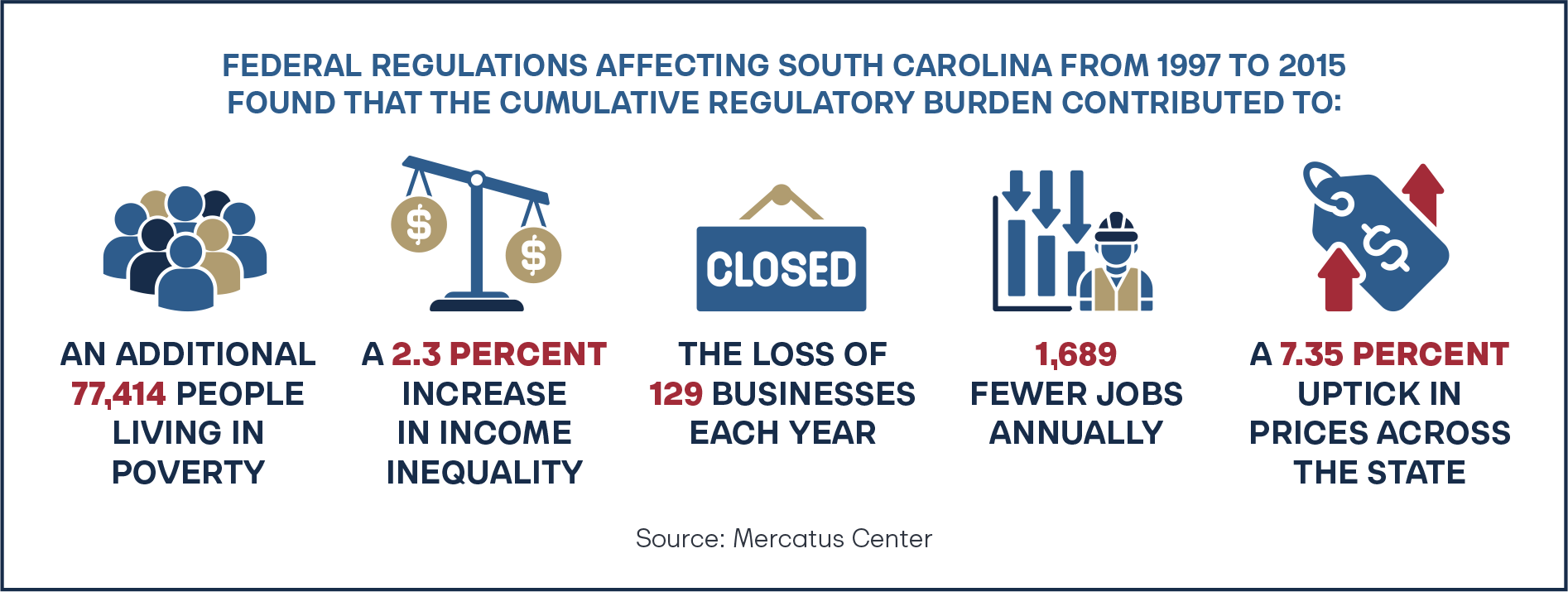

These conditions—dated regulations that never expire, minimal cost-benefit analysis (CBA) requirements, excessive judicial deference, and limited executive oversight—create a climate of regulatory inertia. Over time, such inertia works to slow economic growth, encourage rent-seeking by incumbent businesses, raise consumer prices, reduce job opportunities, and inhibit the formation of new enterprises. A study by the Mercatus Center found that past increases in the federal regulatory burden likely reduced the size of the U.S. economy by roughly 25 percent from 1980 to 2012 compared to a scenario with fewer regulatory accretions.5 While this is a national figure, similar reasoning applies at the state level, and the net effect in South Carolina is more poverty, fewer small businesses, and less innovation.

To counter this regulatory inertia, South Carolinians require a greater and opposite force—reforming not just the rules but also the procedures that produce them. By ensuring that agencies have explicit delegations of authority, requiring robust ex ante (based on forecasts) and ex post (after the fact) cost-benefit analyses, instituting automatic sunset provisions, and restoring meaningful judicial review, South Carolina can promote a nimbler and more responsive regulatory environment. One recent legislative proposal, the Small Business Regulatory Freedom Act, exemplifies a thoughtful, comprehensive approach that prioritizes accountability, transparency, and public interest over bureaucratic inertia.

South Carolina’s tremendous growth potential is currently held back by antiquated regulatory procedures. Fortunately, the state can align its regulatory framework with its demographic and economic trajectory, inviting a more dynamic, prosperous, and innovative future.

The Problem: Structural Weaknesses in South Carolina’s Regulatory Framework

Lack of Explicit Statutory Delegation Coupled with Excessive Judicial Deference

A central flaw in South Carolina’s regulatory architecture is that agencies often regulate without a firm statutory tether. In other words, state law does not consistently require agencies to show that the legislature has explicitly authorized the rules they promulgate. Absent a clear delegation of authority, agencies can drift into what should be the legislature’s domain—deciding fundamental policy questions rather than merely implementing them. This arrangement dilutes democratic accountability because voters elect legislators, not agency officials. When regulators assume legislative powers, the link between voter preferences and policy outcomes weakens, undermining transparency, legitimacy, and economic outcomes.

These issues are magnified by the courts’ posture of expansive judicial deference to agencies in statutory interpretation. At the federal level, Chevron deference—the now-overturned doctrine under which courts uphold agency interpretations of ambiguous statutes if they are “reasonable”—dramatically increases agencies’ chances of success in litigation.6 According to a landmark Michigan Law Review study of more than 1,500 appellate cases, agencies prevail about 77.4 percent of the time under Chevron, as compared to much lower success rates under de novo review (review from the beginning). More telling, when appellate courts reach “step two” of Chevron (the point at which courts defer to an agency’s “reasonable” interpretation of an unclear statute), agencies win a staggering 93.8 percent of the time.7 In June, in Loper Bright v Raimondo, the U.S. Supreme Court overturned Chevron, emphasizing that courts, not agencies, must exercise independent judgment to interpret ambiguous statutes.8 But the Supreme Court’s opinion does not apply to state laws and rules of interpretation.

South Carolina’s standard is even more deferential than Chevron. Rather than merely deferring to agency interpretations deemed “reasonable,” the state’s courts grant what has been labeled Chevron-plus deference.9 Under South Carolina’s Faile v. SC Employment Security Commission (1976), an agency’s interpretation must stand unless there are “cogent reasons” to reject it, and the judiciary is obliged to treat agency readings with “the most respectful consideration.”10 Walker and Menon explain, “This approach … seems to create a highly deferential regime that requires deference anytime there is a delegation of authority.”11 In practice, this means that even if a statute is ambiguous, South Carolina courts are even less inclined than their federal counterparts to reject the agency’s chosen path. Chevron-plus emboldens agencies to push boundaries, secure in the knowledge that courts will rarely intervene, and simultaneously encourages the legislature to leave statutes vague, knowing agencies will likely survive judicial scrutiny regardless.

This climate fosters regulatory overaccumulation, unnecessary red tape, and a compliance maze that drains resources from businesses, discourages entrepreneurial ventures, and burdens consumers through higher prices and fewer choices. Over time, the result is a regulatory landscape that thwarts economic dynamism, reduces accountability, and chokes off the innovation and growth that South Carolina should be nurturing.

Regulatory Accretion, Inertia, and the Absence of Mandatory Sunsets

At their best, regulations fill legislative gaps and guide market actors toward socially and economically beneficial outcomes. Even free-market thought leaders like Friedrich Hayek concede that targeted interventions can address market failures. Yet good rules must adapt or give way when circumstances change, and in South Carolina, this crucial evolution rarely happens. While agencies are required to review regulations periodically, no law compels the removal of rules that have outlived their purpose. Consequently, old mandates remain on the books, adding unnecessary layers of compliance that slow growth, deter entrepreneurs, and strain resources.

Like barnacles accruing on a ship’s hull, outdated regulations accumulate in South Carolina’s code, creating a drag on economic activity. Rather than serving the public interest by adjusting to new realities, these entrenched rules preserve inefficiencies and lock in yesterday’s solutions, even as they produce new problems and impose burdens on every existing and new business in the state.

The underlying cause of regulatory inertia is misaligned incentives. Agencies and political officials are motivated to write new rules—justifying budgets, building portfolios, and signaling responsiveness—while facing no comparable pressure to remove old ones. This asymmetry ensures that the regulatory stock only grows. Companies are forced to navigate a dense thicket of mandates that may no longer be relevant, and overburdened regulators expend energy overseeing policies that no longer serve their original aims. Without mandatory sunset provisions or active pruning, South Carolina’s regulatory code will continue to ossify.

Weak and Easily Gamed Cost-Benefit Analysis Requirements

A robust cost-benefit analysis (CBA) is widely recognized as a crucial instrument to ensure that regulations align with the public interest rather than special interests.12 In theory, CBA framework compels agencies to weigh potential economic, social, and environmental outcomes before imposing new burdens on citizens and businesses. South Carolina law acknowledges the importance of CBA methods, directing agencies to consider various factors—such as costs, benefits, competition effects, employment impacts, environmental consequences, and distribution of burdens—before finalizing regulations.13 Taken together, these statutory requirements, on paper, look like a blueprint for thoughtful, evidence-based policymaking.

In practice, however, South Carolina’s existing CBA mandates are largely aspirational and lack teeth.

The laws read:

“(3) a determination of the costs and benefits associated with the regulation and an explanation of why the regulation is considered to be the most cost-effective, efficient, and feasible means for allocating public and private resources and for achieving the stated purpose;

…

(8) a conclusion on the short-term and long-term economic impact upon all persons substantially affected by the regulation, including an analysis containing a description of which persons will bear the costs of the regulation and which persons will benefit directly and indirectly from the regulation;

(9) the uncertainties associated with the estimation of particular benefits and burdens and the difficulties involved in the comparison of qualitatively and quantitatively dissimilar benefits and burdens. A determination of the need for the regulation shall consider qualitative and quantitative benefits and burdens;”14

The law’s language is permissive and does not require agencies to include many critical elements in preliminary assessments. Nor does it demand that agencies provide a rigorous, quantifiable analysis in their final reports. Instead, agencies may express benefits and burdens in qualitative terms and are free to omit significant components—such as the impact on costs of living or doing business—until the final stages of rulemaking. There are no robust mechanisms to verify the accuracy or completeness of the agencies’ analyses, no stringent enforcement to ensure genuine consideration of alternatives, and no automatic triggers for re-evaluation if the predicted benefits fail to materialize.

Permissive CBA language opens the door to rent-seeking and regulatory capture. Large incumbent players with the resources to influence the rulemaking process can sway “costbenefit” discussions to favor their interests. Without stringent accountability or verification, agencies can comply in form but not in substance, introducing rules that deliver negligible net benefits while still appearing to check procedural boxes. Moreover, current CBA requirements focus almost entirely on forward-looking projections—purely speculative exercises often prone to optimistic assumptions—while neglecting retrospective evaluations that would confirm whether existing rules actually achieved their intended outcomes. Absent accountability, the door remains open for costly, inefficient, or unnecessary rules to persist indefinitely, ultimately eroding trust in the regulatory process and burdening the very people and businesses the rules are meant to help.

Limited Executive Oversight and Transparency

South Carolina’s regulatory code is sprawling and intricate, containing nearly five million words and tens of thousands of restrictive terms.15 Despite the Governor’s constitutional role as the chief executive, there is no systematic apparatus—such as a dedicated office of regulatory management or an independent review commission—to ensure that agencies remain accountable to the state’s top elected statewide official. In some other states, governors or their designees can meaningfully intervene, review, revise, or halt rules that prove too costly, outdated, or misaligned with public priorities. In South Carolina, however, such strategic levers of control are largely absent, leaving the Governor’s office functionally sidelined in the face of uncoordinated and often opaque rulemaking.

Without an executive entity capable of enforcing standardized analytical methods, verifying cost-benefit claims, or demanding timely updates to outdated regulations, agencies effectively operate with minimal external checks. The result is a patchwork of rules that even sophisticated businesses struggle to decipher, let alone small and midsize firms with limited legal resources. This opacity breeds uncertainty, discouraging investment, innovation, and entrepreneurial risk-taking.

To compound matters, the current arrangement does not guarantee that the public can readily access the data, methodologies, or assumptions behind proposed regulations. Without accessible and machine-readable documentation, stakeholders cannot easily find the laws to determine whether a rule is necessary, proportionate, or beneficial. In turn, information asymmetry skews the playing field in favor of well-resourced interests that can afford to hire consultants and lobbyists, leaving smaller competitors and ordinary citizens in the dark.

Economic Consequences: Poverty, Inequality, and Reduced Growth

Taken together, South Carolina’s regulatory problems—weak legislative delegation, extreme judicial deference, outdated rules that never sunset, lackluster cost-benefit analyses, and an absence of transparency and effective executive oversight—distort incentives and inflate the cost of doing business. While these shortcomings may seem abstract, their real-world consequences are clear. Research from the Mercatus Center on only the federal regulations affecting South Carolina from 1997 to 2015 found that the cumulative regulatory burden contributed to an additional 77,414 people living in poverty, a 2.3 percent increase in income inequality, the loss of 129 businesses each year, 1,689 fewer jobs annually, and a 7.35 percent uptick in prices across the state.16 While these figures stem from federal rules, South Carolinians can reasonably expect similar consequences for the flawed state-level regulations that pile atop these federal burdens, compounding damage and amplifying the negative effects on the state’s economy.

Beyond quantifiable harms, overregulation creates fertile ground for regulatory capture. Well-connected firms and interest groups can exploit vague statutes and opaque rulemaking processes to their advantage, putting smaller competitors and consumers at a disadvantage. Distorted incentives mean that regulations, originally intended to protect the public and improve markets, instead stifle innovation, raise costs, and entrench incumbents, often by design. In this environment, policymakers face greater difficulty cleaning up the mess. As agencies gain power, the feedback loops that might correct bad rules weaken, leaving South Carolina’s economy weighed down by inertia and a tangle of outdated, inefficient mandates.

The Solution: Systematic Procedural Reforms

South Carolina can break free from regulatory inertia and inefficiency by reforming the upstream processes that govern rulemaking. Rather than treating symptoms—trying to strike down a handful of burdensome regulations—the state should adopt a comprehensive statutory framework that strengthens accountability, clarifies agency authority, imposes meaningful cost-benefit requirements, and ensures that obsolete rules are eliminated automatically.

A Revolutionary Regulatory Reform Bill: The Small Business Regulatory Freedom Act

One promising blueprint in South Carolina is the Small Business Regulatory Freedom Act, introduced by State Representatives Jeff Bradley, G.M. Smith, William Herbkersman, Matthew Lawson, and Brandon Newton and referred to the South Carolina House’s Labor, Commerce and Industry Committee.17 This proposed legislation, if passed, would constitute perhaps the boldest and most consequential state-level regulatory reform in U.S. history. The bill contains several pivotal items designed to unleash South Carolina’s economy:

No Regulation Without Delegation

Rather than allowing agencies to roam freely into policy domains without legislative guidance, the Act ensures that regulators must anchor their actions in clear, statutory authority. Additionally, the Act proactively curbs regulatory accumulation by requiring agencies to remove outdated rules whenever they propose new ones. The proposed provisions read:

“An agency may not promulgate any regulation unless the agency has been expressly granted the power to do so by a statutory delegation.”

“When an agency proposes a regulation for promulgation, the agency also shall identify and propose the removal of two existing regulations for each regulation the agency proposes to add.”

Automatic Expiration Every Eight Years

Long-lived rules that never expire often outlast the conditions they were designed to address and sometimes even outlive the statutes providing the agency with its delegation to write a regulation. By mandating routine expiration, the Act ensures that the regulatory code remains fresh, relevant, and responsive, saying:

“All administrative regulations expire on January first of the eighth calendar year after their effective date unless readopted pursuant to this section.”

Rigorous Cost-Benefit Analysis (CBA)

The Act calls for a genuine assessment of whether a rule’s benefits outweigh its costs—a linchpin reform that weeds out inefficiencies and guarantees that each regulation advances, rather than hinders, human flourishing. It specifies:

“The assessment report must contain a cost-benefit analysis that clearly demonstrates that the projected benefits of the regulation exceed its projected costs.”

Retrospective CBA Upon Sunset (A First-of-Its-Kind Provision)

Most regulatory systems only look forward, basing decisions on speculative projections. This Act introduces a backward glance, ensuring that rules deliver on their promises and providing a model for other states and the federal government. It reads:

“When a regulation is reviewed for renewal, the agency must conduct a retrospective assessment report and compare the initial projected assessment report and the retrospective assessment report using actual data rather than mere projections.”

Continuously Updating Analytical Standards (Another National First)

Markets evolve, technologies advance, and best practices shift. By dynamically updating analytic methods, the Act ensures regulatory precision and encourages ongoing policy learning by requiring that:

“Standardized analytic methods and measures must be applied to all regulations. These standards must be updated in accordance with best practices and predictive success.”

De Novo Judicial Review

Deference to agencies has too often tipped the scales away from accountability. This provision restores the courts’ proper role, ensuring that statutory ambiguities aren’t quietly exploited to expand regulatory power, requiring:

“In interpreting a state agency regulation, the court shall not defer to the agency’s interpretation of the statute or rule and instead shall interpret the statute or rule de novo,” and,

“After applying all customary tools of interpretation, the court shall resolve any remaining ambiguity against increased agency authority.”

Public, Transparent, and Machine-Readable Data (Yet Another First)

In the information age, transparency and accessibility are non-negotiable. By making all underlying data publicly available in machine-readable formats, the Act empowers citizens, businesses, and researchers to scrutinize, understand, and challenge proposed rules. Specifically, it requires:

“All documentation, assumptions, methods, and data for the assessment report must be published on a publicly accessible website and, where relevant, in a machine-readable format.”

These reforms, including several first of their kind policy innovations—retrospective CBAs, dynamic analytical standards, and unprecedented technology-based transparency—would firmly establish South Carolina as a pioneer in regulatory reform. The package would not only foster a more vibrant, competitive state economy but also serve as a testbed for national policymakers. By implementing these reforms, South Carolina can demonstrate proof of concept for other states and even the federal government.

Independent Oversight and the Role of a “DOGE” or Virginia-Style ORM

While the Small Business Regulatory Freedom Act offers a robust framework for reinvigorating the rulemaking process, one critical piece remains underdeveloped—the governor’s role in restoring regulatory integrity. Simply mandating stricter procedures and cost-benefit analyses may not suffice if the executive branch lacks meaningful levers to oversee and align agency actions with statewide priorities. Without a strong, centralized oversight body, even the best-intentioned reforms risk languishing amid bureaucratic inertia.

To address this gap, South Carolina should consider establishing an independent oversight entity—akin to a state-level “Department of Government Efficiency” (DOGE) or the Virginia Office of Regulatory Management (ORM)—housed within the Governor’s office. Armed with authority to analyze proposed rules, enforce cost-benefit standards, and review existing regulations for obsolescence, such a body can ensure that agencies are accountable not only to legislative mandates but also to the elected chief executive. This would allow the Governor to act as an active gatekeeper, preventing overreach, demanding transparency, and insisting on rigorous application of the new procedural standards.

Virginia’s ORM model demonstrates how active oversight can produce tangible benefits. By setting clear reduction targets, encouraging agencies to cut unnecessary words and mandates, and offering credit for efficiency gains, Virginia has shown that strategic executive oversight can streamline governance and deliver significant savings for citizens and businesses. A recent report in The Regulatory Review estimates that ORM reforms “are saving Virginia citizens over $1.2 billion per year.”18 South Carolina can adopt a similar approach, embedding a culture of continuous improvement into its regulatory apparatus.

In the long run, elevating the governor’s role and establishing a dedicated oversight mechanism will help South Carolina realize the full promise of the Small Business Regulatory Freedom Act.

By implementing bold reforms, South Carolina will not only become a national leader in regulatory reform but also serve as a testbed for innovations that may later shape federal policy. By proving that rigorous, transparent, and accountable regulation is possible and stimulates robust economic growth, South Carolina will be positioned to influence broader legislative and judicial philosophies nationwide, guiding the next chapter in American regulatory governance.

Legal Remedies and Venue Freedom

A key strength of the Small Business Regulatory Freedom Act is recognition that meaningful judicial review requires accessible legal remedies. It specifies:

“Any person aggrieved by a regulation may challenge the validity of the regulation on the grounds that the agency lacked express statutory authority to promulgate the regulation. The challenge may be brought in a court of competent jurisdiction, and the court has the power to declare the regulation invalid if it finds that the agency lacked express statutory authority to be promulgated.”

This provision is a substantial step forward, ensuring that individuals and businesses can directly contest rules that lack a proper legal foundation.

However, to fully empower citizens and entrepreneurs, South Carolina should go even further. Explicitly extending venue freedom by opening the door to the courts in the plaintiff’s home county or principal place of business would reduce barriers to justice, making it more feasible for smaller firms or individuals to press their case. By reducing the geographic and logistical burdens of litigation, South Carolina can create a more balanced and accessible legal landscape while simultaneously ensuring that administrative decisions are adjudicated by ideologically diverse judges. Venue freedom, in turn, would foster a meaningful check on agencies and reinforce the principle that any attempt to regulate without clear statutory authority will face swift and effective accountability.

Conclusion

South Carolina is well-positioned to unleash unprecedented economic growth. Already the fastest-growing state in the nation—outpacing even Florida and Texas—the Palmetto State boasts strong labor markets, a burgeoning entrepreneurial landscape, and a political climate that encourages responsiveness. Yet, if South Carolina is to leverage its population boom and maximize economic momentum, it must address structural flaws in its regulatory framework that slow innovation, deter entrepreneurship, and impose hidden costs on citizens and businesses.

The Small Business Regulatory Freedom Act offers a bold and comprehensive roadmap for reform. The state should require explicit statutory delegations, automatically sunsetting rules every eight years, mandating rigorous and retrospective cost-benefit analyses, restoring true judicial oversight, and introducing unprecedented transparency. These reforms would directly and immediately help South Carolinians by reducing prices, bolstering labor markets, encouraging new business formation, and ensuring that the rules of the game reflect the public interest rather than narrow special interests. South Carolina can strengthen proposed reforms even further by providing the governor real tools for oversight, such as a DOGE or Virginia-style ORM, and granting citizens expanded venue freedom to challenge unlawful regulations in their home counties.

Enacting these reforms will not only position South Carolina as the nation’s regulatory leader, unleashing economic potential at home, but will also establish a model of governance that can inspire state policymakers elsewhere—and even federal leaders. By becoming a cutting-edge laboratory for procedural innovation, South Carolina can demonstrate proof of concept for broader national changes—charting a path to a leaner, more accountable, and more dynamic regulatory environment that could guide the next wave of federal-level reform.

Stay Informed

Sign up to receive updates about our fight for policies at the state level that restore liberty through transparency and accountability in American governance.