Patient’s Right to Save: Colonoscopy Cash vs Average Insurer Rates in Nashville, Tennessee

Can Cash Prices for Healthcare be More Affordable Than Insurance Rates?

Survey finds that new Tennessee law will give patients access to cash prices that are often less expensive than insurance rates.

Introduction

Many patients and elected officials assume their health insurance company negotiates the lowest rates for in-network care in the area. We set out to test this assumption, starting in Nashville, TN. The legislature passed and Governor Bill Lee signed into law an exciting reform that allows a patient to get deductible credit if they pay cash for a more affordable covered service. That law went into effect July 1st and has the potential to create a real market for healthcare regardless of insurance plan and/or design.

Our survey found there is a huge opportunity for patients to save significant amounts of money under a version of Cicero’s Patient’s Right to Save Act, which helped inform the new TN law.

Survey Key Takeaways

- Cash prices are dynamic and vary in range.

- Patients have multiple opportunities to pay less for high-quality care when they pay cash compared to the cost of paying and using their insurance.

- Cash price quotes over the phone were often lower than the cash rates hospitals are disclosing under federal rules.

- There is a growing and active cash market where patients can find high-quality, and more affordable care than inside their insurance network, if they are allowed to access such care without deductible discrimination.

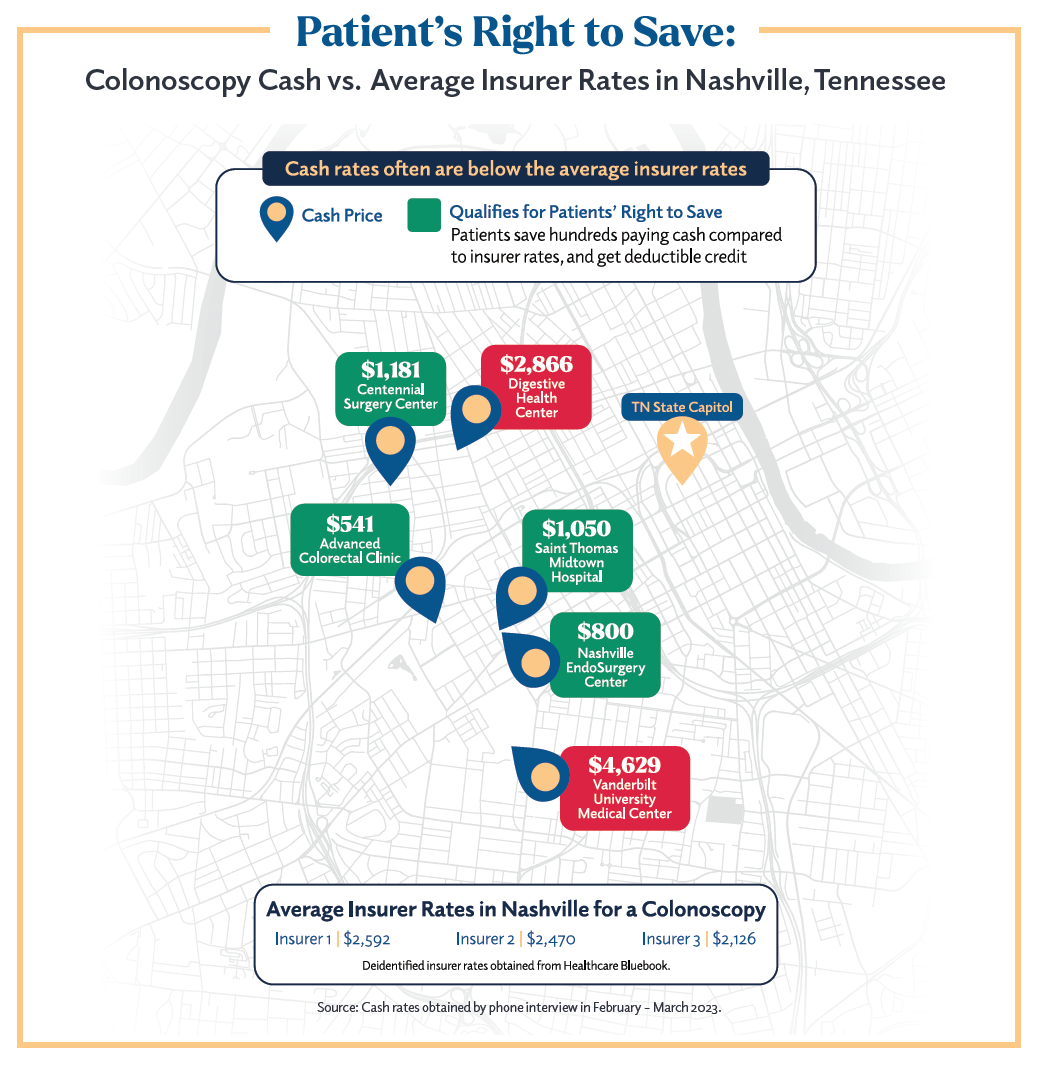

Summary of the Map

The map above discloses the quoted cash prices from six providers offering diagnostic colonoscopies (CPT code 45378) located throughout the downtown Nashville area. Each cash price quote on the map includes commonly associated fees with CPT code 45378 (e.g. service, facility, pathology, and anesthesiology).

The colors represent which cash prices would qualify towards a patient’s deductible and out-of-pocket requirement in the Tennessee individual and small business health insurance market, regardless if the provider has a contract with that insurer.

Green coloring shows that the cash price quote is below the average insurance rates while red coloring shows the cash price quote is above the average insurer rates, and therefore doesn’t qualify for deductible credit.

Unlike negotiated insurance rates or chargemaster rates set by the hospital, the cash price quotes presented on this map are the out-of-pocket estimates a provider would give an uninsured patient over the phone. This map provides a small representative sample of the 14 cash prices obtained in Nashville. The six cash price quotes listed consist of three independent provider facilities while the other three are from hospitals and centers attached to a larger provider system. Also the six cash prices listed include the lowest and highest prices in the data set (e.g., $541–$4,629).

CASE STUDY:

Imagine John Thorpe, a 57 year old man in Nashville, with a history of colonoscopies that have found polyps, is trying to schedule his annual procedure. He is enrolled with insurer number 2, and the average rate they pay is $2,470; which is a staggering 128 percent higher than Advanced Colorectal Clinic’s $541 cash price.

John has a high deductible plan of $6,500 and, given his history, will likely pay the entire cost of the service. If John goes through his insurance he will later pay $2,470 after the clinic files a claim with his insurance. However if John decides to pay the cash price right after the service he will only be charged $541.

Essentially if John pays the cash price, under the Tennessee law, he will save $1,929 and can use that savings for whatever he wants.

The “Average Insurer Rates in Nashville for a Colonoscopy” at the bottom of the map are three deidentified average negotiated rates for CPT 45378 pulled from three major insurers offering coverage to Nashville residents.This graphic contrasts what patients can pay in cash for the service with what they would pay, on average, if they had a deductible obligation they have not met and are using their health insurer.

Survey Methodology

The cash price quotes presented on this map come from a larger data set of 107 provider cash price quotes for CPT 45378 across seven city markets (Nashville, Houston, Phoenix, Tulsa, Miami, Atlanta, and Salt Lake City).

We collected cash price quotes via phone survey with the following steps:

- Surveyors identified providers offering a diagnostic through a Google search and the Turquoise Health website. The sample was limited to those that could be found through a Google search and/or Turquoise Health’s hospital cash price data repository.

- Surveyors called providers and spoke with a billing representative or department.

- The surveyor asked for a self-pay estimate, good-faith estimate, or cash price quote for CPT 45378 (providers use different terminology for cash price quotes). After the billing representative provided a cash price quote the surveyor would confirm that price included all fees (e.g., service, facility, pathology, and anesthesiology fees).

- In addition to the all-inclusive cash price, the surveyor recorded the date of call, the provider’s address.

- Surveyors did not schedule appointments, but merely obtained a cash price quotation.

Discussion & Limitations

Cash Price Sampling:

The cash price quote sample collected in each city market is not wholly representative of the city markets surveyed. Not all providers located in surveyed city markets were accounted for, nor did all providers contacted share their cash price quotes, even though patients are entitled to a good faith estimate.

The reason cash prices quotes were collected in a non-randomized method is because there is not a comprehensive publicly accessible data repository that contains an accurate and up-to-date list of providers’ offering CPT 45378, nor is there a data repository of cash price quotes for all provider types (e.g., hospital, ambulatory surgery centers, and independent colonoscopy/endoscopy centers etc). Currently, some companies like Turquoise Health possess a robust list of hospital cash prices, but since the CMS price transparency rules only impacts hospitals, smaller and independent providers’ prices are not currently being collected in the same manner as hospitals.

Having cash prices more readily available at all care settings would help patients and providers find affordable care.

Surveyors sought uninsured patient prices to learn how much a doctor would accept for their services, not how much a patient would need to pay if they have insurance, because the intent of this surveying was to obtain cash price quotes, not out-of-pocket amounts post insurance coverage. Additionally, some billing representatives refused to disclose the cash price if they suspected the surveyor to possess health insurance, or they wanted to sign the caller up for Medicaid, medical credit card, or the Obamacare exchange plans. Additionally, when surveyors did disclose they were surveying for prices in preliminary test calls, billing representatives often refused to disclose prices in that context or forcefully encouraged the surveyor to look at their website (e.g., hospitals).

Under federal law, Americans are entitled to a good faith estimate for the total out-of-pocket cost a patient would pay for getting a medical service if they want to self-pay. Our research team cannot speak to the exact reasons some providers refused to offer cash price quotes despite the law requiring it. Reasons for refusal consisted of:

- Patients must set an appointment with the provider to conduct an assessment for medical necessity before the provider would offer a cash price quote.

- Providers required surveyors to be a current patient within their system before disclosing the price over the phone.

- Billing representatives that suspected surveyors had health insurance refused to disclose the cash price because they believed the surveyor had another form of payment and actively tried steering them away from paying out-of-pocket.

In order to get a cash price quote the research team merely sought the uninsured prices and concluded it was simpler for surveyors to claim they were uninsured.

We used phone call surveying for the following reasons:

- Despite the Centers for Medicare and Medicaid (CMS) creating a hospital price transparency rule where hospitals are supposed to post their chargemaster and discounted cash rates on their websites, not all hospitals are yet in compliance with the rule.

- The CMS Hospital price transparency rule only extends to hospitals meaning ambulatory surgery centers and independent practices offering CPT 45378 are excluded from posting prices on their websites.

- As previously mentioned there is not a comprehensive and publicly accessible data repository that captures all cash prices in a given city market. Meaning there was no streamlined way to acquire cash prices through providers’ websites.

- When calling hospitals for cash price quotes it became apparent that the phone quotes did not match with the cash price listed on hospitals’ websites. In most cases the cash price quote was less expensive when obtained over the phone.

- Phone surveying was also used because it mimics what many patients would resort to doing if they were trying to pay out-of-pocket for a healthcare service, due to their being limited online resources.

Implications:

The results, while limited in scope, reveal a viable cash market with a wide range of options. Additionally, these results show that it’s common to see cash prices below health insurers’ average negotiated rate for CPT 45378 and at times below the lowest negotiated rate. While these results are not exhaustive, the range of prices captured means it’s plausible that incentives can be instituted to encourage patients to find high-quality but less costly options for healthcare services.

Patients Need a Life Boat To More Affordable Care

Patients regularly forgo care over cost concerns, and many find it difficult to find affordable options. This survey found that cash rates can be less expensive, but can be difficult to find in some markets.

Cash marketplaces are growing, for example Sesame Care, Savvos Health, Sidecar Health, and MediBid, but for the tens of millions of Americans with insurance, they face plan design discrimination for seeking out these more affordable care options. That changes under the Tennessee law and Patient’s Right to Save because patients now get deductible credit.

Patients need access to more than just hospital prices and those set by insurance. Patients need a lifeboat to access affordable care in and out of the network. The Tennessee law can help give patients new options by creating a robust cash market that can help every patient regardless of their insurance plan. Deductibles are growing and not all healthcare is subject to small co-payments. Patients deserve other pathways to mitigate costs wherever they can. Other states should follow Tennessee’s lead and seek to end network and plan discrimination.

Stay Informed

Sign up to receive updates about our fight for policies at the state level that restore liberty through transparency and accountability in American governance.